Analysis of Friday's Trades

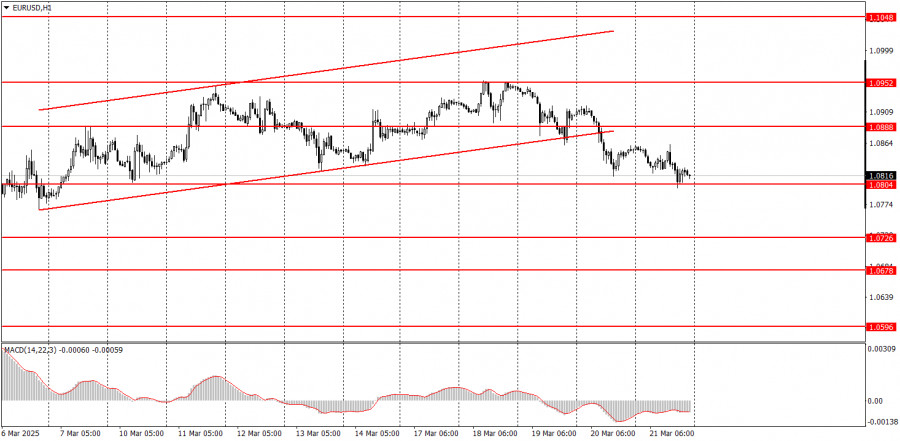

1H Chart of EUR/USD

The EUR/USD currency pair continued a sluggish downward movement on Friday. A few days earlier, the price had broken below the ascending channel, so a decline in the euro was to be expected. There were no significant events in the Eurozone or the U.S. on Friday, which explains the low volatility. However, it's worth noting that the pair has generally shown low volatility in recent weeks. The market has "digested" Donald Trump's tariff headlines and is no longer mindlessly selling the dollar. On Wednesday evening, Jerome Powell stated that there are no problems with the U.S. economy. This somewhat calmed the market, and the Fed maintained its previous hawkish stance, which implies no more than two rate cuts in 2025. While the U.S. economy may slow due to trade wars, the same applies to the UK and the EU. Essentially, we saw an emotional sell-off of the dollar, not backed by concrete fundamental or macroeconomic drivers. A correction is now overdue.

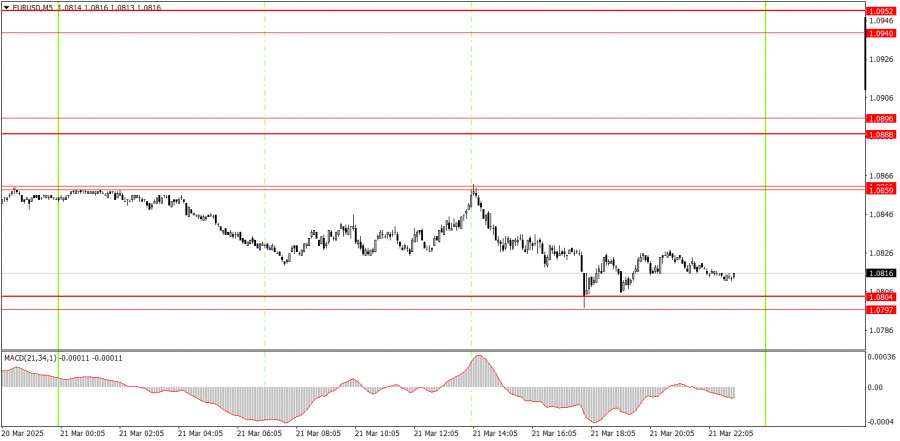

5M Chart of EUR/USD

On the 5-minute timeframe, several signals were formed on Friday, but intraday movements were weak. The 1.0845–1.0851 zone has been shifted to 1.0859–1.0861. In the previous version of this area, buy and sell signals were triggered on Friday. The buy signal was false, while the sell signal was profitable, as the nearest target was reached. As a result, novice traders couldn't incur a loss on Friday, but profiting from such weak moves was also quite difficult.

Trading Strategy for Monday:

In the hourly timeframe, EUR/USD remains in a medium-term downtrend, but the chances of its continuing are diminishing. Since the fundamental and macroeconomic background continues to favor the U.S. dollar much more than the euro, we still expect further decline. However, Donald Trump keeps pulling the dollar down with his constant tariff decisions and vision for U.S. global dominance. Fundamentals and macroeconomics remain overshadowed by politics and geopolitics, so a strong dollar rally is not expected for now.

On Monday, the euro may continue to fall, as for the first time in a while, the market reacted to fundamentals correctly (the Fed meeting), and technically, the pair has broken below the ascending channel. The dollar has been oversold and undervalued too sharply and without sufficient justification. A correction is likely.

On the 5-minute chart, watch the following levels: 1.0433–1.0451, 1.0526, 1.0596, 1.0678, 1.0726–1.0733, 1.0797–1.0804, 1.0859–1.0861, 1.0888–1.0896, 1.0940–1.0952, 1.1011, 1.1048. On Monday, preliminary March PMI data for the services and manufacturing sectors will be published in Germany, the Eurozone, and the U.S. These are moderately important reports, but they may provoke a market reaction.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.