Hello, dear colleagues!

Just over a week has passed after the key meetings of central banks, which means it is time to look at how markets have perceived their decisions and what consequences it may lead to. The series of meetings in mid-December included both expected and very unexpected decisions, which will have an impact not only on the first quarter, but for the entire next year in 2023.

In turn, take note that the current situation is very favorable for the global, i.e. US financial system, which managed to avoid negative events in 2022. Back in October of the outgoing year, people expected the global economy to slide into recession but it didn't turn out so bad, and now GDP is forecast to fall next year. This happened due to fairly strong data on consumer activity, due to a decrease in inflation and, most importantly, a decrease in energy prices in the second half of 2022.

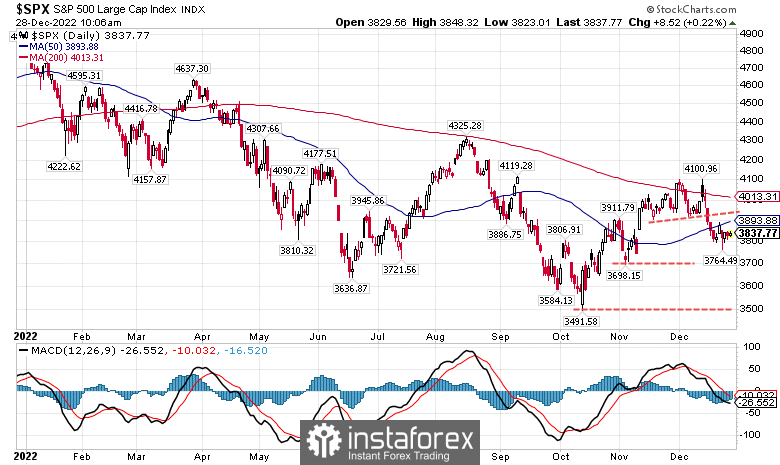

The key meeting of central banks was the meeting of the U.S. Federal Open Market Committee that was held last week. The decision to raise the target federal funds rate by 50 basis points was quite expected, but traders were highly disappointed in the comments which followed the announcement, after which the US stock indices started to decline actively. However, the decline was quite predicted by the technical analysis (Fig.1) and statements of the Federal Reserve officials.

Fig.1: Technical diagram of the S&P 500 #SPX index. Daytime.

As Figure 1 shows, the S&P 500 #SPX index has been in a declining trend since early 2022, and its rise from 3,491 to 4,100 in October and November 2022, according to the rules of technical analysis, was merely a correction to the descending momentum. Fundamentally, there was virtually no basis for such a growth. It is assumed that markets have overestimated the Fed's desire to start cutting rates next year. As a result of panic closure of positions at the end of the year, the market lost half of its autumn growth.

The current technical picture allows us to conclude that the stock markets' negative dynamics will continue in the future, around one to three months. The first target will be the #SPX 3,700 low, and the next target for the #SPX decline will be 3,500. There is one more detail that you should pay attention to: if the U.S. stock market declines next year, it will most likely fall more than it did in 2022. So the stock market may not stop at these targets and there is a high probability that it will not stop.

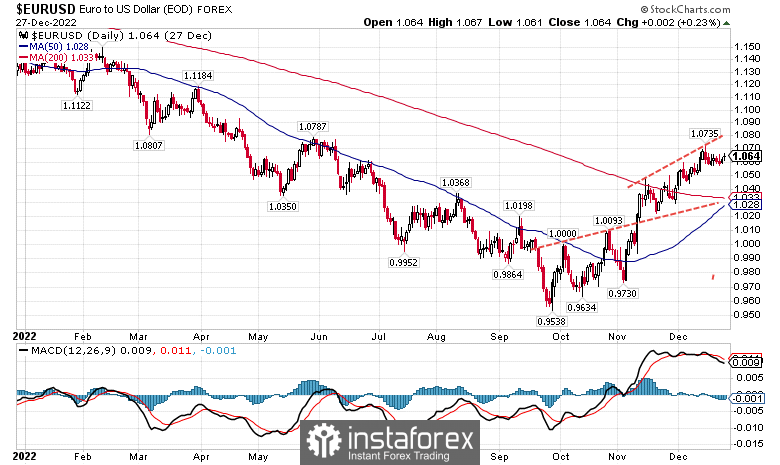

The second most important meeting in December was the European Central Bank meeting, which, as well as the Fed, had raised the rate by 50 basis points, which was quite unexpected, because earlier the rate was raised by 75 bps, and inflation in the euro area isn't even slowing down. Such a decision has one practical application in terms of trading. The fact is that a slowdown in rate hikes raises the possibility that the euro will depreciate against the U.S. dollar in the short-term, which will happen as the potential of rates between the dollar and the euro remains unchanged. Earlier the markets were counting on another ECB rate hike of 75 bps in December and considered that in the exchange rate, which allowed the euro to reach 1.0735.

By the way, this conclusion is confirmed by the technical picture of the EURUSD exchange rate (Fig.2). From mid-November to mid-December, the euro exchange rate formed a "rising wedge" pattern, which in most cases breaks down. Short-term targets for such decrease can be 1.03 and 1.01. Such a possible decrease has another reason: the fact that the EURUSD rate grew quickly enough, during one and a half months the rate rose from 0.973 to 1.0735, which is more than 10%, and this is a lot, considering that such changes are rare in the currency market. The markets were hoping too much for an active rate hike by the ECB, and now comes the disappointment, leading to sales of the European currency.

Fig.2: Technical picture of the EURUSD exchange rate, daily chart

EURUSD may take up to a month to realize its short-term targets for corrections. So we can say that the EUR exchange rate may enter a bearish correction in January.

In the future, a lot will depend on the dynamics of interest rates in dollars and euros. If the Fed slows down the pace of rate hikes and the ECB continues to raise rates in increments of 50 bps, it may lead to further growth of the euro. In the medium-term daily dynamics, from one to three months ahead, the EURUSD remains in an upward phase, so after a short-term decline in the zone from 1.03 to 1.01, it may well resume growth.

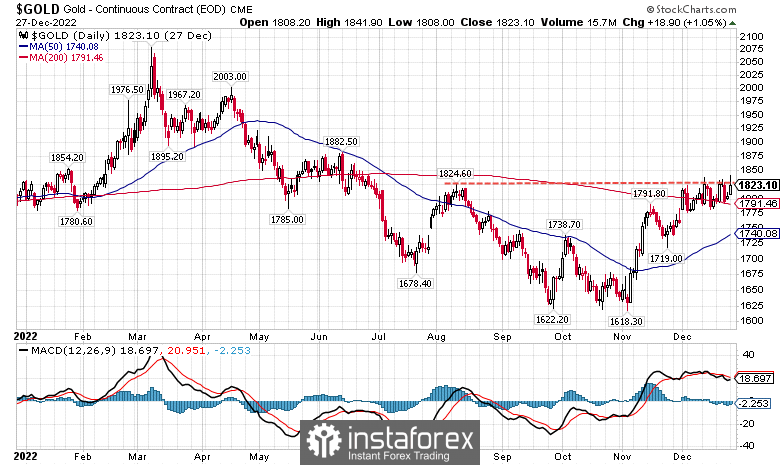

One more tool, which can be indirectly influenced by central banks' interest rates through exchange rates, is gold. Fundamentally, gold, like any other commodity, is quoted in dollars and is very dependent on demand in the United States. God forbid we see the relationship between gold and the dollar as a rigid correlation, but in short-term periods such a relationship can be seen, and it may well be the case now.

Take note that gold, as well as the euro, formed a "rising wedge" in its dynamics and was unable to keep the resistance level above $1,825 (Fig.3). Also, take note that gold's low in October at 1,622 coincided with the euro low at 0.9538.

Fig.3: Technical picture of the gold price, daily chart

I assume that if the euro starts to fall and the U.S. dollar strengthens in the short term, then gold prices will also begin to fall. The bearish target for gold might be $1,720.

But in case gold closes the year behind the resistance of $1,825, it has a good chance to rise further, which can occur despite the dynamics of the U.S. dollar and the currency market in general. Moreover, as I said before, the dollar will stay in a downtrend for one to three months, which is a good thing for gold in this case.

In general, we cannot rule out a paradigm shift in gold, when the dollar-euro-gold link might change into a dollar-yen-gold link, where gold begins to correlate with the yen instead of the dollar. Such a correlation has already been observed for quite a long time in the last decade. Also, keep in mind that in the long run, gold appreciates against the U.S. dollar and has risen in value more than 60 times over the past 50 years. Be careful, be cautious, and follow the rules of money management.