On Tuesday, the GBP/USD currency pair traded much more calmly, yet again showed signs of a "maxed-out flat" pattern. As previously noted, the US dollar has only had two behaviors lately: it falls or remains flat. The option of growth simply doesn't exist. And as we've repeatedly stated, the sole reason is Donald Trump's new trade policy. However, this factor alone could negatively affect the US economy...

For instance, many now believe that a recession is inevitable. Even the Fed couldn't trigger a recession with its ultra-high interest rates. Donald Trump, however, has proven within the first three months of his second term that nothing is impossible when you try hard enough. Currently, nearly all market participants expect a recession, but they blame Trump personally and take out their frustration with the dollar. A trade war will affect more than just the US; other countries aren't seen as the instigators. We're increasingly convinced that the fall in the US stock market and the dollar is a protest by market participants against the policies of the new-old president.

There are also questions surrounding the Fed's monetary policy. As a reminder, the European Central Bank has already cut rates seven consecutive times, unlike the Fed, which stubbornly remains on pause. Yet, this hasn't affected the euro's exchange rate at all. If a hawkish Fed and a dovish ECB can't trigger a drop in EUR/USD, imagine what will happen if the Fed starts cutting rates too.

The same logic applies to the Bank of England and the British pound. The BoE is slightly more hawkish than the ECB, but the principle is the same—what happens to the dollar if the Fed joins the rate-cutting crowd? We're skeptical because Jerome Powell keeps emphasizing that the Fed's dual mandate is price stability and full employment. However, achieving full employment is impossible in a recession. That creates a tricky dilemma: tariffs may cause inflation to rise, meaning the Fed can't cut rates; simultaneously, a shrinking economy and weakening labor market would demand lower rates. What the Fed decides to do in this scenario remains a mystery.

As for the British pound—it doesn't have to do anything to continue rising. In the past, before Trump, it required strong macroeconomic data from the UK, a hawkish BoE, and political stability. Now, none of that matters. As a result, the pound could continue to rise indefinitely—at least until the global trade war de-escalates. Where the dollar or the US economy will be by that point is anyone's guess. Long-term and even medium-term forecasts are practically meaningless right now.

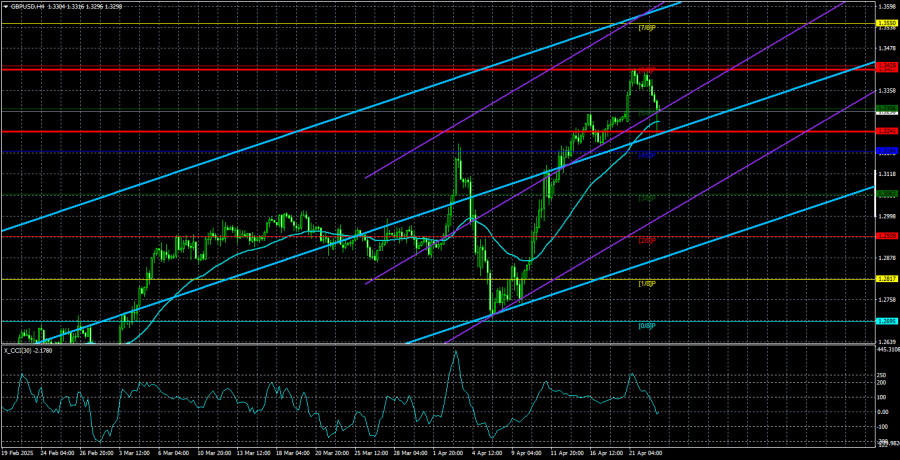

The average volatility of GBP/USD over the last five trading days is 82 pips, which is considered "average" for the GBP/USD pair. Therefore, on Wednesday, April 23, we expect the pair to move between 1.3286 and 1.3450. The long-term regression channel points upward, signaling a clear bullish trend. The CCI indicator has again entered the overbought zone, but during strong uptrends, these signals typically only imply a correction.

Nearest Support Levels:

S1 – 1.3306

S2 – 1.3184

S3 – 1.3062

Nearest Resistance Levels:

R1 – 1.3428

R2 – 1.3550

R3 – 1.3672

Trading Recommendations:

The GBP/USD pair continues to move confidently upward. We still believe that this is merely a correction on the daily time frame that has become irrational. However, if you trade based on pure technicals or "on Trump," long positions remain relevant with targets at 1.3450 and 1.3550, as the price is trading above the moving average. Especially considering that the pound continues to rise almost daily without an apparent reason. Sell orders are still attractive, with targets at 1.2207 and 1.2146, but at the moment, the market isn't even considering buying the dollar—while Trump regularly triggers fresh sell-offs of the US currency.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.