Analysis of Trades and Trading Tips for the British Pound

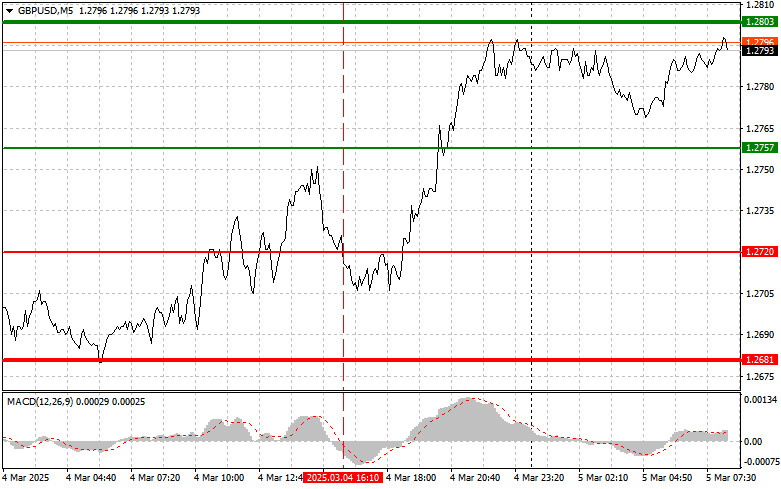

The price test at 1.2720 occurred when the MACD indicator had already moved significantly below the zero mark, limiting the pair's downside potential. For this reason, I did not sell the pound. I did not see any other entry points into the market.

Expectations of improved economic prospects for the UK drive the strengthening of the British pound. Falling inflation and stabilizing energy prices fuel optimism about consumer spending and business activity. Investors, who previously feared a recession, are now adjusting their forecasts towards more moderate growth. However, despite the positive trend, the pound remains vulnerable to geopolitical risks and uncertainties related to US trade tariffs.

Today, the UK services PMI and composite PMI are expected. Strong data would provide another reason to buy GBP/USD, while weak figures could push the pair lower, considering the pound's overbought state amid the lack of positive economic reports. Besides PMI, it is worth paying attention to speeches by Bank of England representatives today. Their comments on the economic outlook and future interest rate plans could significantly impact the pound's exchange rate.

For intraday strategy, I will focus more on executing Scenarios #1 and #2.

Buy Signal

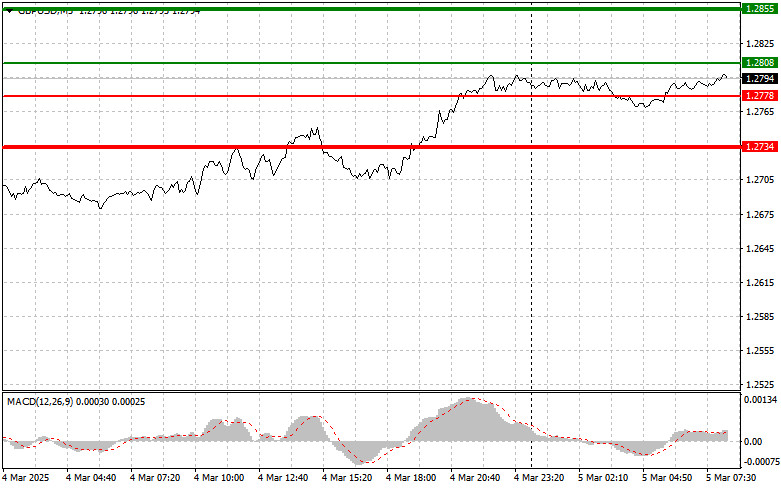

Scenario #1: Today, I plan to buy the pound if the entry point reaches around 1.2808 (green line on the chart) with a target of rising to 1.2855 (thicker green line on the chart). Around 1.2855, I plan to exit my buy positions and open sell trades in the opposite direction, expecting a 30-35 pip pullback. A continuation of the upward movement could support further pound growth. Important! Before buying, ensure that the MACD indicator is above the zero mark and starting to rise.

Scenario #2: I also plan to buy the pound if there are two consecutive tests of the 1.2778 price level while the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to a market reversal to the upside. A rise toward the opposite levels of 1.2808 and 1.2855 can be expected.

Sell Signal

Scenario #1: Today, I plan to sell the pound after it breaks below 1.2778 (red line on the chart), which would lead to a rapid decline in the pair. The key target for sellers will be 1.2734, where I plan to exit my sell positions and immediately open buy trades in the opposite direction, expecting a 20-25 pip pullback. Selling the pound is preferable at the highest possible price. Important! Before selling, ensure that the MACD indicator is below the zero mark and starting to decline.

Scenario #2: I also plan to sell the pound if there are two consecutive tests of the 1.2808 price level while the MACD indicator is in the overbought area. This will limit the pair's upside potential and lead to a market reversal downward. A decline toward the opposite levels of 1.2778 and 1.2734 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.