Trade breakdown and tips for trading the euro

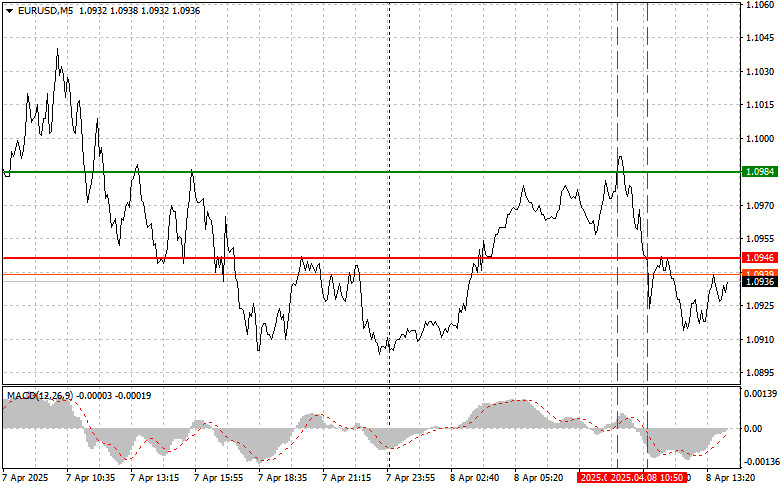

The test of the 1.0984 level coincided with the moment when the MACD indicator had already moved far above the zero line, which limited the pair's upward potential. For this reason, I didn't buy. A similar situation, but for selling, occurred at the 1.0946 level, so I stayed out of the market.

Market instability hasn't gone anywhere, and the lack of positive economic news from the Eurozone allows euro bears to become active at the slightest sign of an upward movement. In this environment, traders should be especially cautious and closely analyze economic news and geopolitical events that may influence currency dynamics—specifically, news related to US trade tariffs. Any positive development could revive demand for risk assets.

In the second half of the trading day, the main event will be the publication of the NFIB Small Business Optimism Index. This indicator reflects sentiment in the small business sector, which plays a significant role in job creation and overall economic growth. The National Federation of Independent Business conducts monthly surveys among numerous small companies across the country to assess their expectations for future sales, profitability, hiring, investment plans, and inventory levels. The final index, based on the collected data, gives insight into the overall level of confidence or concern among small business owners. A significant drop in the index could weaken the US dollar and help the euro recover. Otherwise, pressure on the EUR/USD pair will likely persist.

As for the intraday strategy, I will focus mainly on implementing scenarios #1 and #2.

Buy Signal

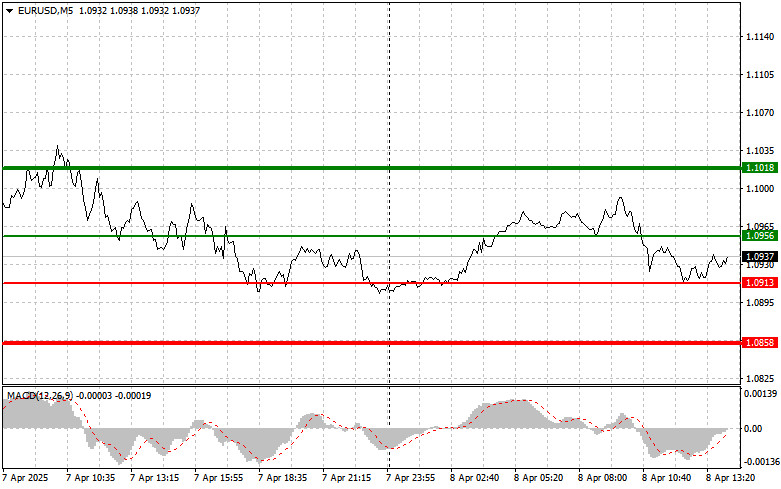

Scenario #1: Today, buying the euro is possible upon reaching the price area of 1.0956 (green line on the chart) with the target of rising to 1.1018. At 1.1018, I plan to exit the market and open a sell position in the opposite direction, aiming for a 30–35 point reversal. Expecting euro growth today will be quite difficult. Important! Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy the euro if the price tests the 1.0913 level twice consecutively, at a moment when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a market reversal upward. A rise to the opposite levels of 1.0956 and 1.1018 can be expected.

Sell Signal

Scenario #1: I plan to sell the euro after the price reaches the 1.0913 level (red line on the chart). The target will be 1.0858, where I plan to exit the market and immediately buy in the opposite direction (expecting a 20–25 point reversal from the level). Pressure on the pair could return if the data is strong. Important! Before selling, make sure the MACD indicator is below the zero line and just beginning to decline from it.

Scenario #2: I also plan to sell the euro if the price tests 1.0956 twice consecutively, while the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline to the opposite levels of 1.0913 and 1.0858 can be expected.

What's on the chart:

- Thin green line – entry price at which to buy the trading instrument;

- Thick green line – suggested price to set Take Profit or manually secure profits, as further growth above this level is unlikely;

- Thin red line – entry price at which to sell the trading instrument;

- Thick red line – suggested price to set Take Profit or manually secure profits, as further decline below this level is unlikely;

- MACD indicator – it's important to use overbought and oversold zones when entering the market.

Important: Beginner Forex traders should be extremely cautious when deciding to enter the market. Before the release of major fundamental reports, it's best to stay out of the market to avoid sharp price swings. If you choose to trade during news releases, always place stop-loss orders to minimize losses. Without stop-losses, you could quickly lose your entire deposit, especially if you're not using money management and trading with large volumes.

And remember, successful trading requires a clear plan—just like the one I've laid out above. Making spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.